Bid To Cover Ratio Bonds. For example if the auction sells a RM 5 million bond and it receives RM 10 million worth of bids then the BTC for this bond is at 20x indicating there are twice the amount of bid for the bond compared to the available units. It measures the total number of bids in an auction for government securities against the number of successful bids.

At the most recent auction for 30-year bonds the government sold 24 billion worth of securities. 2012 Farlex Inc. In particular using a sample of Belgian French German and Italian auctions we.

Investors submitted bids indicating they were willing to buy almost 60 billion worth of bonds resulting in a bid-to-cover ratio of 247 above the 2020 average ratio of 236.

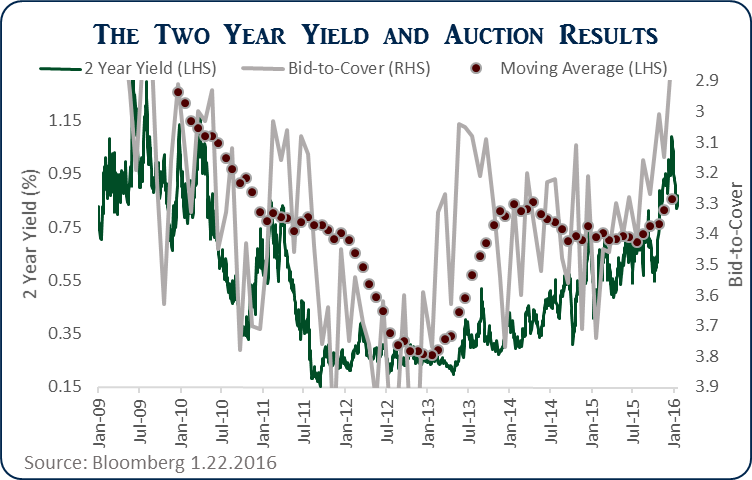

Bid to cover is the ratio of the amount of bids in the auction vs the amount of bonds sold. It measures the total number of bids in an auction for government securities against the number of successful bids. The bid-to-cover ratio a gauge of demand was 269 stronger than both the 239 ratio in February and the 240 average ratio. Save US 10-year T-Note Bid-to-cover Ratio Total amount of bids received total amount fo bids accepted bid-to-cover ratio Total amount of bids received measures demand for primary market bond.